Credit Repair Myths Debunked: Separating Truth from Fiction

Credit Repair Myths Debunked: Separating Truth from Fiction

Blog Article

Comprehending Just How Debt Repair Service Works to Enhance Your Financial Wellness

Understanding the mechanics of credit history repair work is important for any person looking for to boost their monetary health and wellness. The procedure incorporates determining mistakes in credit rating records, disputing inaccuracies with credit history bureaus, and bargaining with creditors to attend to arrearages. While these actions can dramatically affect one's credit score, the trip doesn't finish there. Establishing and keeping audio monetary practices plays a just as critical function. The inquiry remains: what particular methods can people use to not only fix their credit report standing yet additionally guarantee enduring economic stability?

What Is Debt Repair Service?

Credit history repair service refers to the procedure of boosting an individual's creditworthiness by resolving inaccuracies on their credit report, negotiating financial obligations, and taking on better monetary habits. This multifaceted technique intends to improve an individual's credit rating rating, which is a critical consider securing fundings, bank card, and beneficial rates of interest.

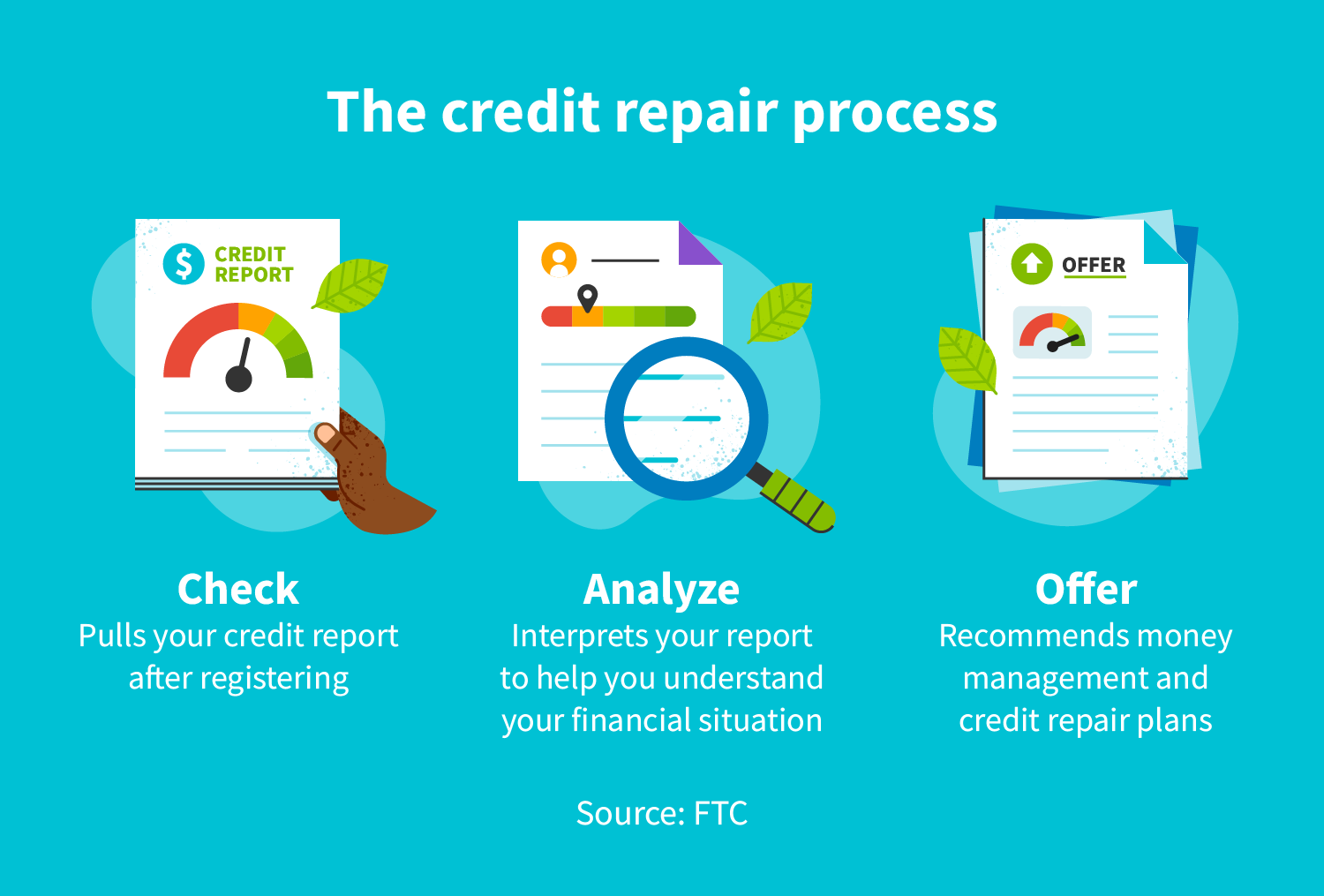

The credit history repair service procedure typically begins with a comprehensive evaluation of the person's credit score record, permitting the identification of any type of disparities or errors. When errors are determined, the individual or a credit scores repair service professional can launch conflicts with credit report bureaus to correct these concerns. Furthermore, working out with financial institutions to settle arrearages can additionally boost one's financial standing.

Furthermore, adopting sensible financial practices, such as prompt costs payments, lowering credit score use, and preserving a varied credit rating mix, adds to a healthier credit rating profile. On the whole, credit score repair offers as an essential method for individuals seeking to gain back control over their economic wellness and secure better loaning chances in the future - Credit Repair. By taking part in credit score fixing, individuals can lead the way toward accomplishing their monetary goals and enhancing their overall quality of life

Common Credit Record Errors

Errors on credit report records can substantially influence an individual's credit report, making it important to comprehend the usual kinds of inaccuracies that might emerge. One common issue is inaccurate individual info, such as misspelled names, wrong addresses, or incorrect Social Safety numbers. These errors can result in complication and misreporting of credit reliability.

Another typical error is the coverage of accounts that do not belong to the person, often as a result of identification burglary or clerical mistakes. This misallocation can unjustly reduce an individual's credit report. Additionally, late settlements might be erroneously taped, which can occur as a result of settlement processing mistakes or inaccurate reporting by lending institutions.

Credit scores limits and account balances can likewise be misstated, leading to an altered sight of a person's credit report application ratio. Understanding of these typical errors is vital for effective debt monitoring and repair, as resolving them promptly can help people maintain a healthier economic account - Credit Repair.

Actions to Dispute Inaccuracies

Contesting mistakes on a debt record is a crucial procedure that can aid restore a person's credit reliability. The initial step entails acquiring a current duplicate of your credit rating record from all three significant credit history bureaus: Experian, TransUnion, and Equifax. Evaluation the report carefully to determine any type of errors, such as inaccurate account info, balances, or payment histories.

Next off, start the conflict process by speaking to the relevant credit bureau. When sending your conflict, plainly outline the inaccuracies, supply your proof, and consist of personal identification info.

After the dispute is filed, the credit rating bureau will certainly check out the insurance claim, usually within thirty days. They will connect to the financial institution for confirmation. Upon completion of their investigation, the bureau will certainly educate you of the end result. If the conflict is resolved in your support, they will certainly fix the record and send you an updated copy. Maintaining precise records throughout this procedure is crucial for reliable resolution and tracking your credit score wellness.

Building a Strong Credit Profile

Constructing a strong credit scores account is necessary for securing beneficial financial opportunities. Constantly paying credit history card expenses, lendings, and other responsibilities on time is vital, as repayment background substantially affects debt ratings.

Furthermore, preserving low debt usage ratios-- preferably under 30%-- is essential. This implies keeping credit card equilibriums well below their Visit Website limitations. Diversifying credit kinds, such as a mix of revolving credit report (credit scores cards) and installation car loans (vehicle or home mortgage), can likewise enhance credit rating accounts.

Consistently keeping an eye on credit reports for errors is similarly essential. People ought to assess their debt records a minimum of annually to identify disparities and contest any kind of errors without delay. Additionally, staying clear of excessive credit rating questions can prevent potential unfavorable influence on debt ratings.

Lasting Benefits of Credit History Repair

Moreover, a stronger credit score account can help with much better terms for insurance coverage premiums and even influence rental applications, making it simpler to safeguard housing. The psychological advantages need to not be forgotten; people that successfully repair their credit usually experience decreased anxiety and enhanced self-confidence in managing their financial resources.

Verdict

In final thought, credit score repair work offers as a vital mechanism for boosting economic health. By identifying and contesting errors in credit scores reports, individuals can fix mistakes that adversely affect their credit rating ratings.

The lasting advantages of credit scores fixing expand much beyond just improved debt ratings; they can significantly enhance a person's general financial health.

Report this page